Take control of your lease accounting

Lease accounting a challenge that requires control

Managing lease accounting under IFRS 16 and Local GAAP can be complex and time-consuming, often requiring substantial resources. Take a moment to discover how we can assist you!

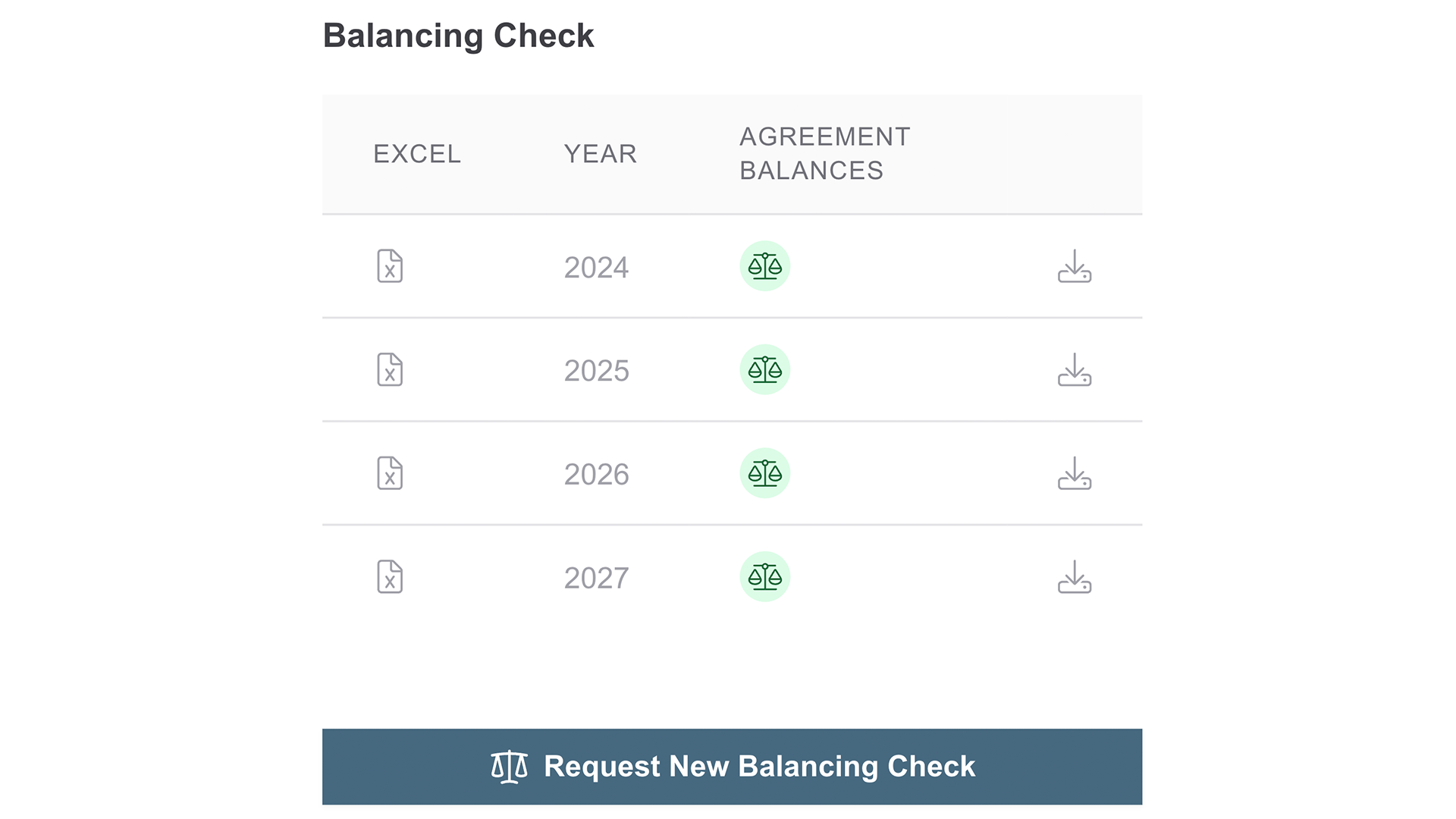

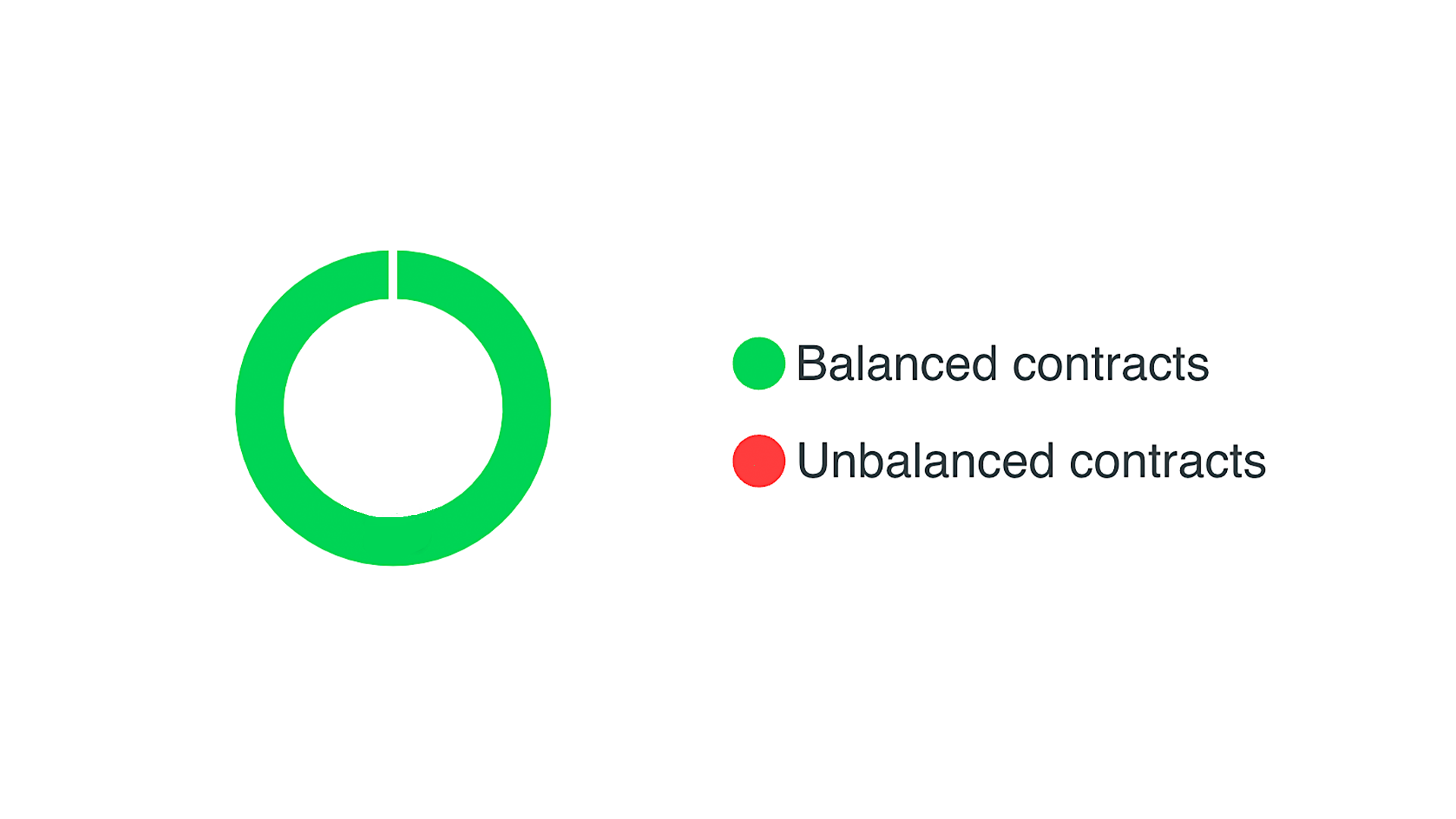

Complete control over your contracts

Taking control of your contracts enhances not only your accounting but also compliance and overall financial performance. Our tools ensure that all figures are accurate, providing you with confidence in your reporting.

Consolidate leasing agreements in one place

Leasify simplifies the accounting of leasing agreements with a SaaS subscription service specifically designed to streamline and enhance the management of the complex accounting requirements that companies face when reporting according to IFRS 16 and Local GAAP standards. The service also represents a new, more efficient way to manage and report leasing agreements.

Contract review

With real-time validations and checks, errors are flagged instantly, making it simple to catch and correct issues that might otherwise slip through.

Keep up with the latest from Leasify

Feelgood: ”We feel confident with the reports from Leasify”

Jun 30, 2025

It’s more than a system – Infrakraft and Leasify in collaboration

Jun 26, 2025

.png?width=2146&height=574&name=Boozt_Logo_Pos%20(1).png)

-2.png?width=1181&height=210&name=didriksons_logo_rgb_black_left_primary%20(kopia)-2.png)