Imagine if your IFRS 16 reporting could be both simple and efficient?

With our solution, it’s a reality. Here’s what you can expect:

Ensure accurate calculations

Excel might feel straightforward at first, but as it becomes more dependent on manual input, the risk of errors increases. We deliver precise and reliable calculations, so you can focus on what matters most.

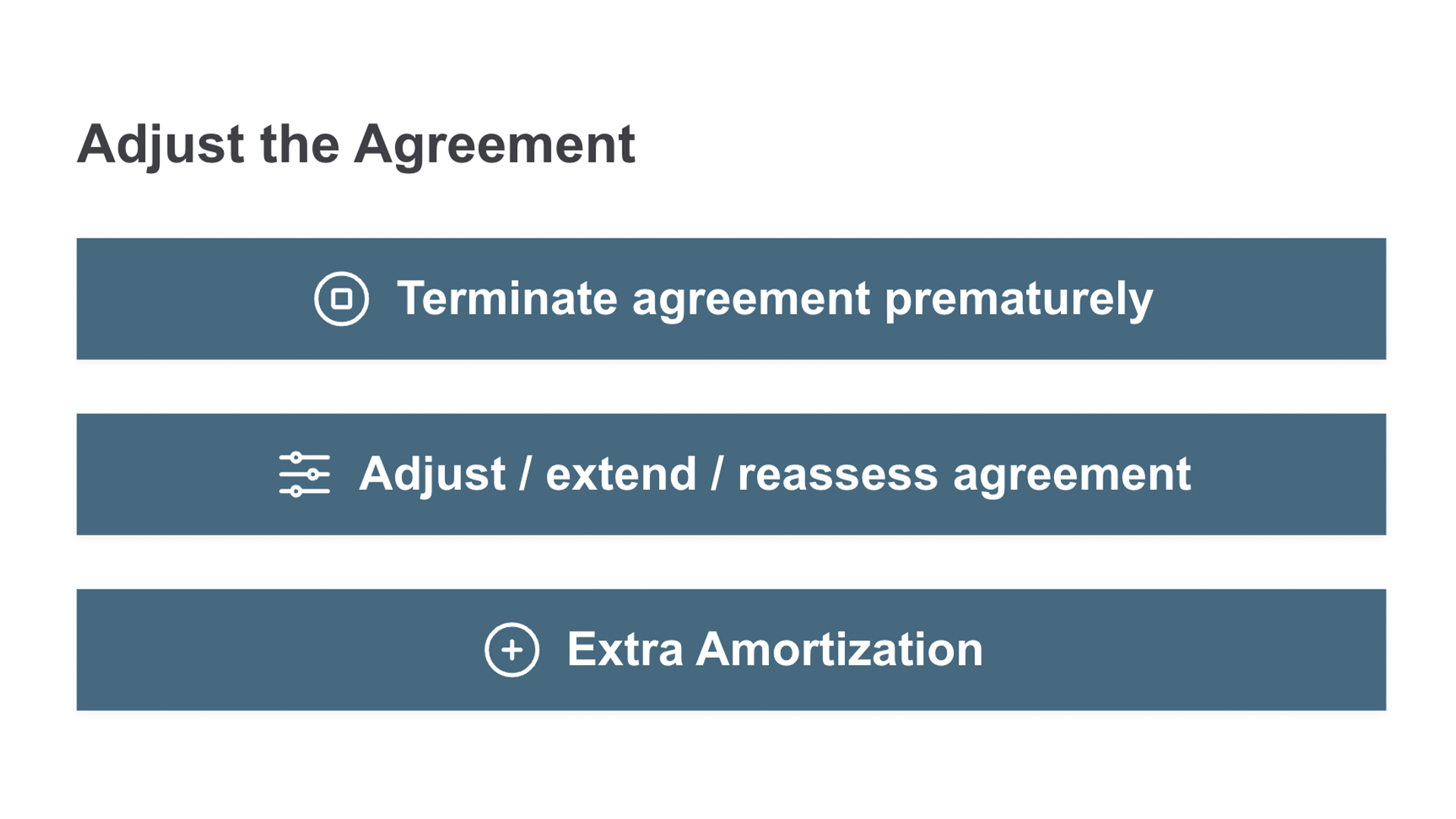

Adjustment features

Indexation, extensions, or early terminations? No problem. Our solution ensures accurate calculations and clear traceability with user-friendly tools.

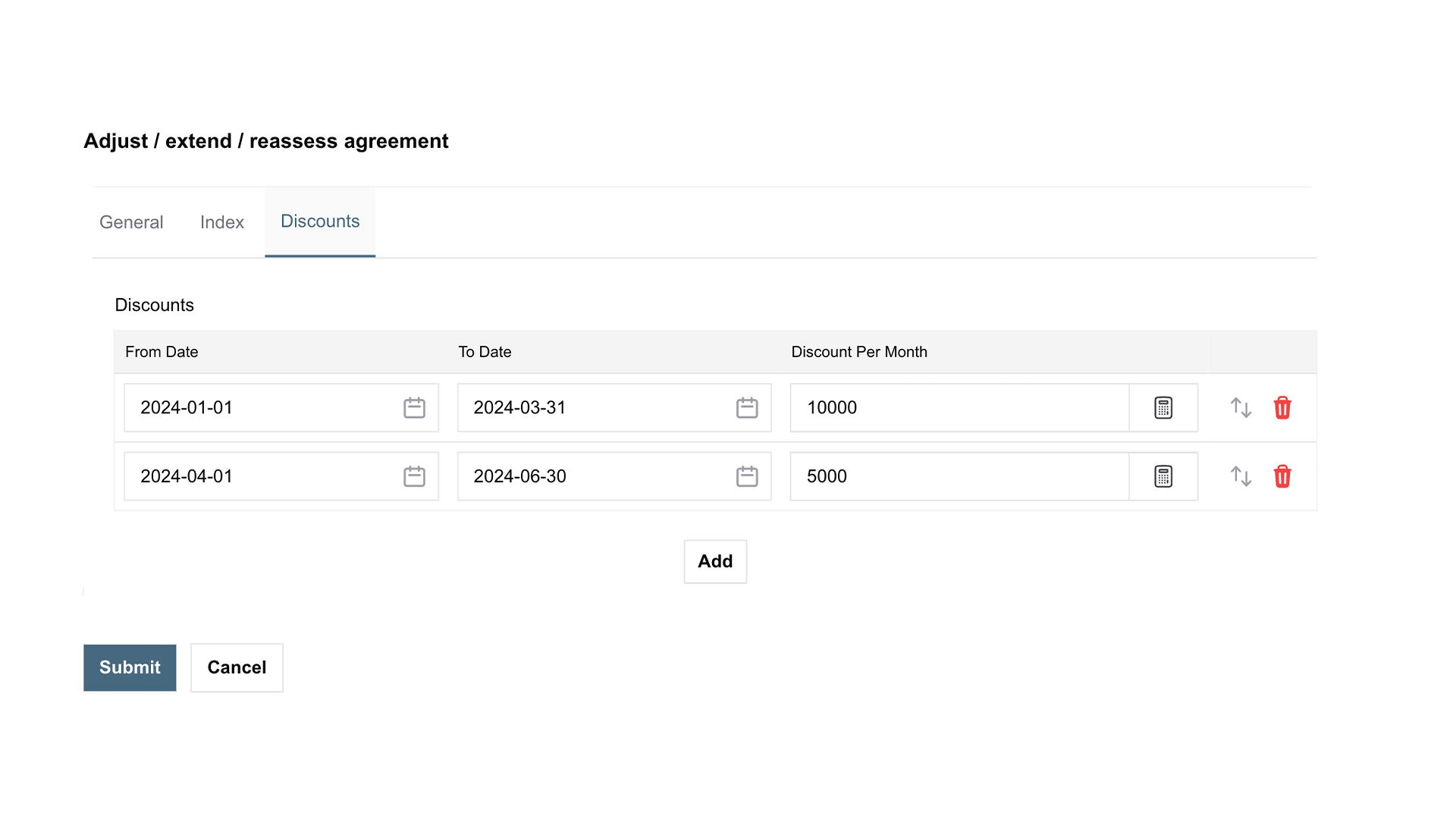

Precise calculations for discounts and variable costs

All contract terms are included to ensure accurate calculations. You can easily manage discounts, initial costs, and annual fee adjustments—both those set at the start of the contract and those that come later, like index changes.

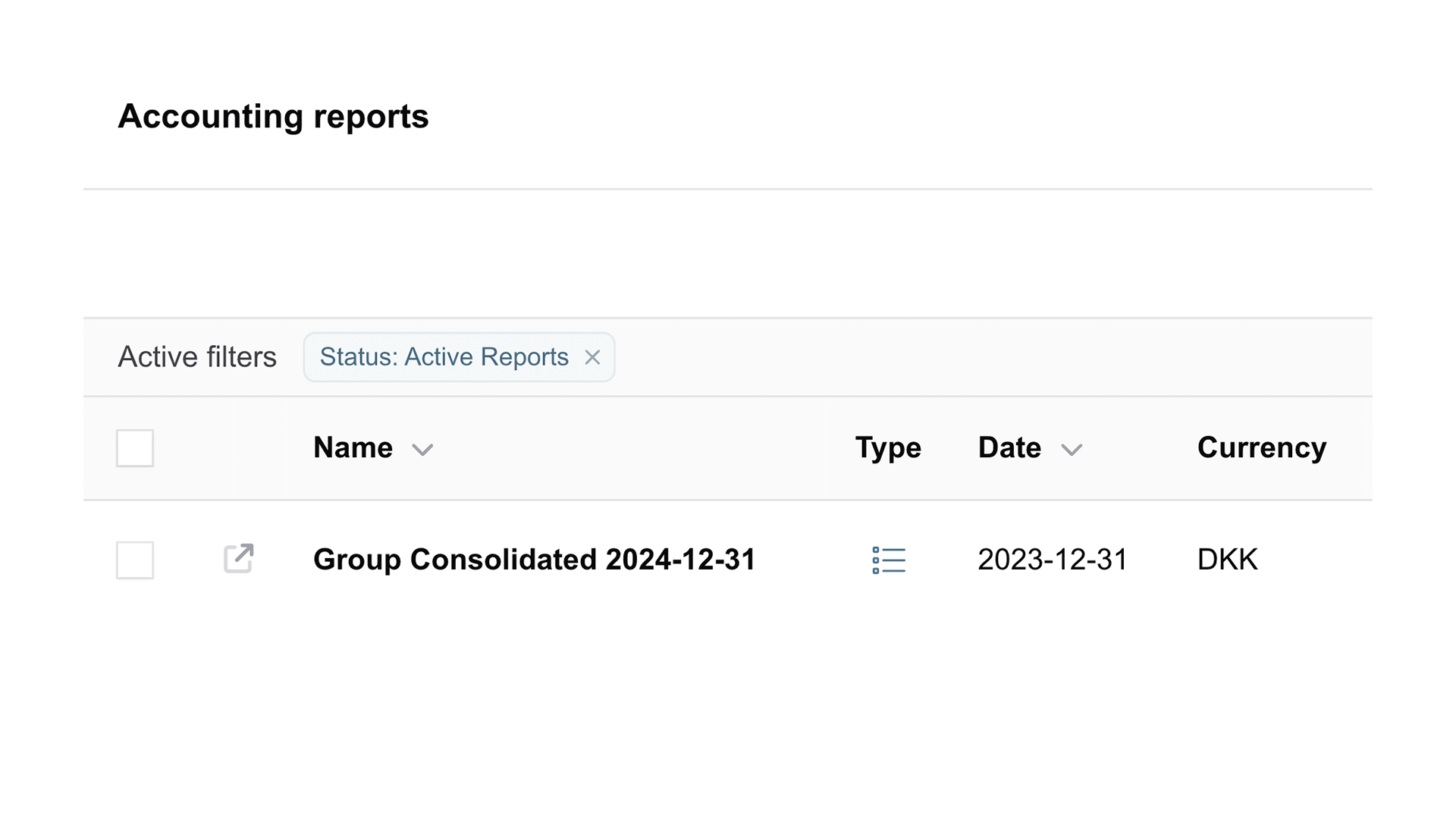

Complete flexibility in group reporting

Need reports at the group level or based on specific requirements? Easily generate flexible reports by company, cost center, or asset type. Plus, the reports can be converted into any currency and provided as an import file for your consolidation system – ensuring simple and efficient management.

.png?width=2146&height=574&name=Boozt_Logo_Pos%20(1).png)

-2.png?width=1181&height=210&name=didriksons_logo_rgb_black_left_primary%20(kopia)-2.png)